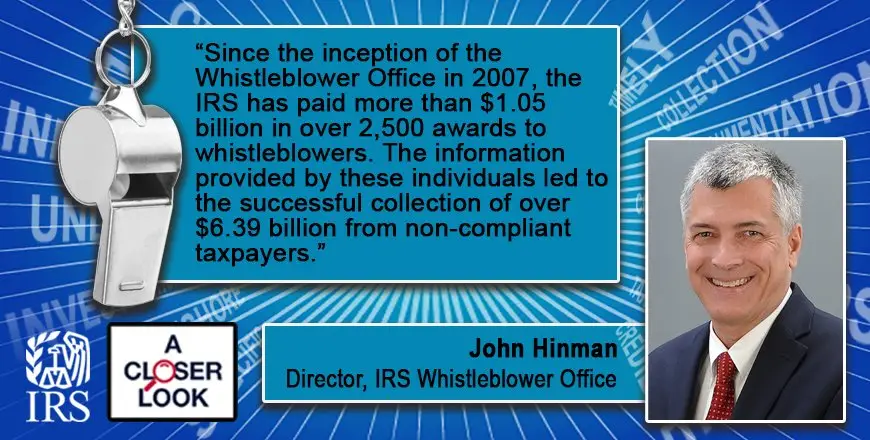

Have specific, timely & credible info that a person or business isn’t complying …

Have specific, timely & credible info that a person or business isn’t complying with tax laws? You could receive an award from the #IRS Whistleblower Office for reporting it. See the latest #IRSCloserLook: https://t.co/xOniEC1R0U https://t.co/3YkGkmTaTz Source by IRSnews

Haven’t yet filed your 2021 tax return? Do it now! #IRS encourages you to file e…

Haven’t yet filed your 2021 tax return? Do it now! #IRS encourages you to file electronically as soon as you’re ready. https://t.co/XFQscxFcu7 https://t.co/s5myrnFZMR Source by IRSnews

SPF isn’t the only number that keeps you and your family safe. An #IRS IP PIN is…

SPF isn’t the only number that keeps you and your family safe. An #IRS IP PIN is a 6-digit number that can help prevent the misuse of your information on fraudulent tax returns. To learn more or to sign up, visit: https://t.co/VKD301xplR #IPPIN https://t.co/9cj046fyPO Source by IRSnews

Watch out for scammers pretending to be the #IRS. A call threatening to arrest, …

Watch out for scammers pretending to be the #IRS. A call threatening to arrest, sue or deport you is a clear sign of a scam. See https://t.co/tRTy9uyTIs #TaxSecurity https://t.co/1C7hy0O9eC Source by IRSnews

Need help calculating the amount of federal income tax to withhold from your emp…

Need help calculating the amount of federal income tax to withhold from your employee’s pay? This #IRS tool can help: https://t.co/vr44l7VOYg https://t.co/O1RZVBkHTw Source by IRSnews

Abusive arrangements kick off the annual #IRS “Dirty Dozen” list. Watch out for …

Abusive arrangements kick off the annual #IRS “Dirty Dozen” list. Watch out for tax savings that are too good to be true: https://t.co/HBbE6BrMFm #TaxSecurity https://t.co/fv0i88vxib Source by IRSnews

Have you heard that the Child Tax Credit is now available to many families in #P…

Have you heard that the Child Tax Credit is now available to many families in #PuertoRico? Well, it’s true! Check out the #IRS site for details and to learn how to claim it: https://t.co/Fp3H52Ni4G https://t.co/505YHhskgg Source by IRSnews

Didn’t request a tax filing extension and still haven’t filed a 2021 #IRS return…

Didn’t request a tax filing extension and still haven’t filed a 2021 #IRS return? Don’t wait. Avoid additional penalties and interest by filing as soon as possible and paying any balance due. https://t.co/MyEyXuAj57 https://t.co/Ap8IS9O1vm Source by IRSnews

Does the thought of filling out an #IRS W-4 form make you nervous? There’s a too…

Does the thought of filling out an #IRS W-4 form make you nervous? There’s a tool on https://t.co/kcgZUfN9B4 to help you. Check out https://t.co/3fQSlsYHt3 #Firsttimefiler https://t.co/8vbXvD3kPg Source by IRSnews

If you filed an extension, you have until Oct. 17 to file…but you don’t have to …

If you filed an extension, you have until Oct. 17 to file…but you don’t have to wait. File electronically as early as possible. Watch this video for more info: https://t.co/ee3Pd36yJC #IRS #FileNowIRS Source by IRSnews