#IRS: More forms can now be amended electronically, including Form 1040-NR, U.S….

#IRS: More forms can now be amended electronically, including Form 1040-NR, U.S. Nonresident Alien Income Tax Return and Form 1040-PR, Self-Employment Tax Return – Puerto Rico. https://t.co/rJaZ4YNzB5 https://t.co/tHeJLP9qjV Source by IRSnews

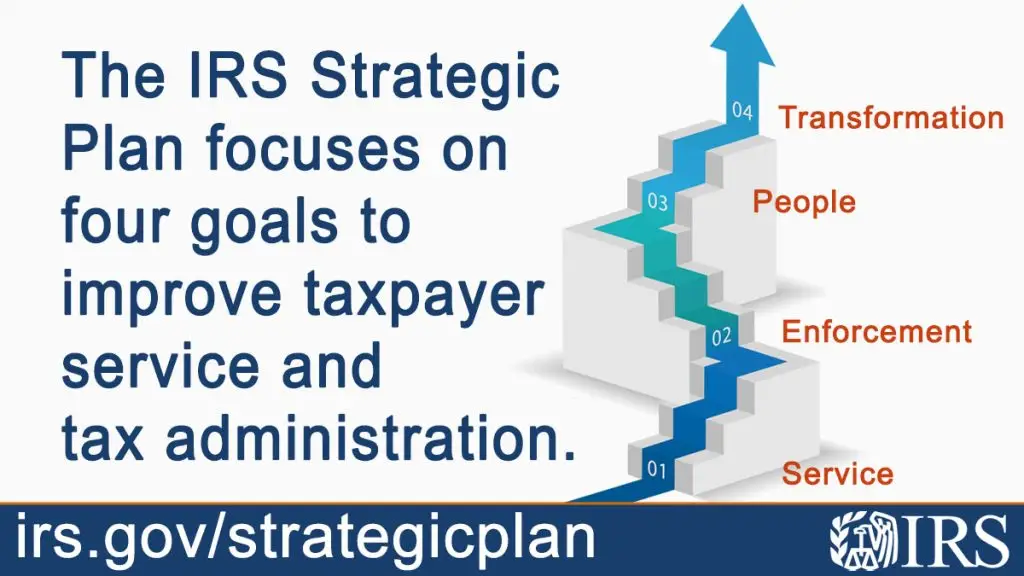

The #IRS Strategic Plan focuses on four goals to help improve taxpayer service: …

The #IRS Strategic Plan focuses on four goals to help improve taxpayer service: •Service •Enforcement •People •Transformation To learn more, see: https://t.co/6lu3R1ufPo https://t.co/7qTSURyJHU Source by IRSnews

#IRSFreeFile can help those with no filing requirement find overlooked tax credi…

#IRSFreeFile can help those with no filing requirement find overlooked tax credits and get an #IRS refund. https://t.co/3byJqk9fiF https://t.co/agVjdxeHRE Source by IRSnews

Contribuyentes que aún necesitan presentar una declaración de impuestos de 2021 …

Contribuyentes que aún necesitan presentar una declaración de impuestos de 2021 deben hacerlo electrónicamente cuando estén listos; No es necesario esperar hasta la fecha límite de prórroga del #IRS de octubre para presentar la solicitud. Echa un vistazo a https://t.co/pkj93uitig https://t.co/dTY0QG77gz Source by IRSnews

#IRS announces more “Dirty Dozen” tax scams for 2022, alerting both taxpayers an…

#IRS announces more “Dirty Dozen” tax scams for 2022, alerting both taxpayers and #TaxPros of the latest schemes — https://t.co/Fb3n00L8Nr #TaxSecurity https://t.co/lxu2iCfo4q Source by IRSnews

The #IRS and the Security Summit encourage #TaxPros to spread the word to client…

The #IRS and the Security Summit encourage #TaxPros to spread the word to clients about enrolling in the #IPPIN program. Read why the ETAAC calls it “the No. 1 security tool” against tax fraud: https://t.co/VKD301xplR. https://t.co/CGXjor4WxF Source by IRSnews

Tax avoidance can bite you back! #IRS reminds you that taxpayers risk steep civi…

Tax avoidance can bite you back! #IRS reminds you that taxpayers risk steep civil penalties and criminal charges for engaging in questionable deals, such as stashing assets in offshore accounts and not reporting digital currency like crypto. https://t.co/bi1C0ePFAv #TaxSecurity https://t.co/TE0IxGFiWy Source by IRSnews

#IRS reminder: People with low- and moderate-incomes may be able to save for ret…

#IRS reminder: People with low- and moderate-incomes may be able to save for retirement with the help of a special tax break. See: https://t.co/k9Qa79uyJX https://t.co/QIKvx5IQKu Source by IRSnews

A new feature allows you to check the status of your current tax year and two pr…

A new feature allows you to check the status of your current tax year and two previous years’ refunds using the #IRS “Where’s My Refund?” tool. The tool is updated daily and gives you a projected refund date as soon as it’s approved. https://t.co/Yyt8kUM8Ip https://t.co/Kdc9cBfuuj Source by IRSnews

DYK what to do if you get a scam phone call from someone pretending to be the #I…

DYK what to do if you get a scam phone call from someone pretending to be the #IRS? Hang up and report it! https://t.co/1xVTULRPXU https://t.co/7pgYU0qTKH Source by IRSnews