Enrolled agents, CPAs or other #TaxPros needing CPEs should consider attending t…

Enrolled agents, CPAs or other #TaxPros needing CPEs should consider attending the 2022 Virtual #IRS Nationwide Tax Forum for live webinars from the IRS and its association partners. Watch this video for more information #IRSTaxForum: https://t.co/FeG5VBgwWv Source by IRSnews

#TaxPros: Consider attending the 2022 Virtual #IRS Nationwide Tax Forum for live…

#TaxPros: Consider attending the 2022 Virtual #IRS Nationwide Tax Forum for live webinars from the IRS and its association partners. For more information and a list of topics, watch this short video #IRSTaxForum: https://t.co/FeG5VBgwWv Source by IRSnews

#TaxSecurity reminder: Taxpayers, #TaxPros and financial institutions should rem…

#TaxSecurity reminder: Taxpayers, #TaxPros and financial institutions should remain vigilant to abusive tax schemes promoted online or over the phone. Here are the ones that landed on this year’s #IRS “Dirty Dozen” list: https://t.co/HBbE6BrMFm https://t.co/Qwz92n86BA Source by IRSnews

#TaxPros: An #IRS tool can help you and your clients find the right amount of fe…

#TaxPros: An #IRS tool can help you and your clients find the right amount of federal income tax to withhold from employee’s pay. Read: https://t.co/vr44l7EdzG https://t.co/fQ9m5Ls8xF Source by IRSnews

Today is the last day for #TaxPros to register to attend the 2022 #IRS Nationwid…

Today is the last day for #TaxPros to register to attend the 2022 #IRS Nationwide Tax Forum and have access to all 32 webinars. Find out more: https://t.co/YC2f432a4i #IRSTaxForum https://t.co/EQUuQRx3L5 Source by IRSnews

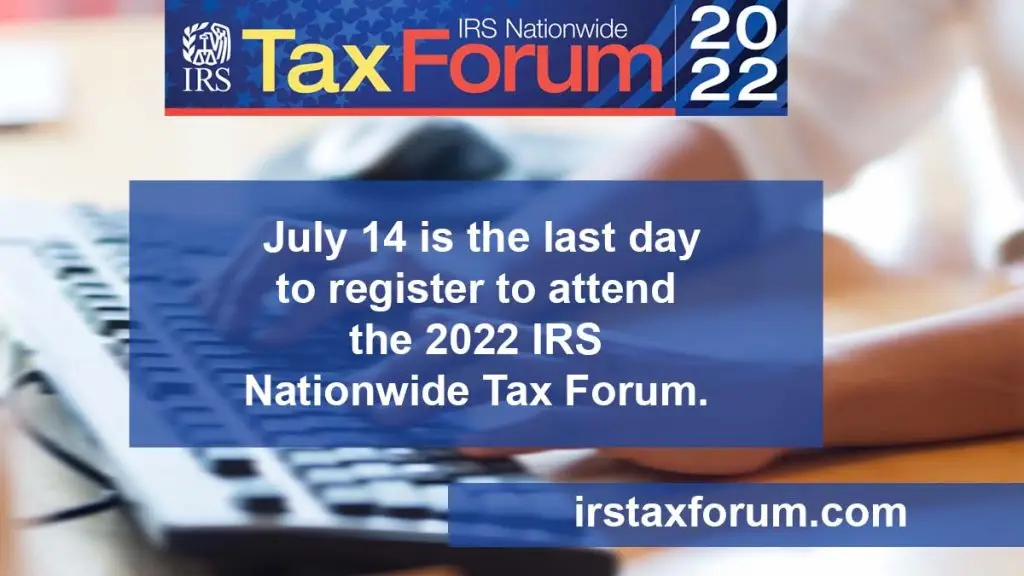

July 14 is the last day for #TaxPros to register to attend the 2022 #IRS Nationw…

July 14 is the last day for #TaxPros to register to attend the 2022 #IRS Nationwide Tax Forum and have access to all 32 webinars. Read more: https://t.co/YC2f432a4i #IRSTaxForum https://t.co/Au1OOIOJxG Source by IRSnews

#IRS and Security Summit warn #TaxPros to watch for tell-tale signs of identity …

#IRS and Security Summit warn #TaxPros to watch for tell-tale signs of identity theft. Learn more at: https://t.co/fZtkAzPcZG #TaxSecurity https://t.co/8lBgys325Y Source by IRSnews

#TaxPros promising huge refunds, demanding cash up front for their services and …

#TaxPros promising huge refunds, demanding cash up front for their services and depositing your refunds into their bank accounts are red flags 🚩 🚩 🚩 . Get to know the #IRS “Dirty Dozen” list for your #TaxSecurity: https://t.co/Fb3n00L8Nr https://t.co/4Oz2ZGBOKr Source by IRSnews

Use an #IRS tool to research #TaxPros near you or to determine the type of crede…

Use an #IRS tool to research #TaxPros near you or to determine the type of credentials or qualifications held by a specific tax professional. See https://t.co/HqF2j0msjF https://t.co/zQEa6Dw2Me Source by IRSnews

#TaxPros: Educating clients who work in the gig economy about their tax obligati…

#TaxPros: Educating clients who work in the gig economy about their tax obligations is important because many don’t receive Form W-2s, 1099s or other information returns. Find resources on the #IRS Gig Economy Tax Center: https://t.co/D5vZt6niFm https://t.co/KEUWlqEpSw Source by IRSnews